32+ michigan payroll tax calculator

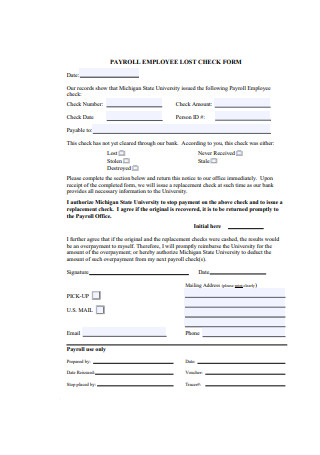

Web For each payroll federal income tax is calculated based on the answers provided on the W-4 and year to date income which is then referenced to the tax tables in IRS Publication. Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place.

How Are Payroll Taxes Calculated State Income Taxes Workest

Web Paycheck Calculator Michigan - MI Tax Year 2023.

. As with federal taxes your employer withholds money from each of your paychecks to put. Web Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Michigan. Compare Choose Which Service is Best Suited for You Your Lifestyle.

Web Michigan collects a state income tax and in some cities there is a local income tax too. Web Estimate how much youll owe in federal taxes for tax year 2022 using your income deductions and credits all in just a few steps with our tax calculator. Fast Easy Affordable Payroll Services For Small Business.

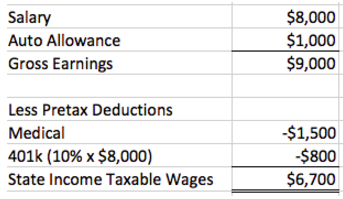

Free Unbiased Reviews Top Picks. All Services Backed by Tax Guarantee. Total annual income Income tax liability Payroll tax liability Pre-tax deductions Post-tax deductions Withholdings Your paycheck.

Web The formula is. Web To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Web Michigan Paycheck Calculator.

Add W-2 employees at any time. Simply enter their federal and state W-4. Web Calculating your Michigan state income tax is similar to the steps we listed on our Federal paycheck calculator.

Select a State Annual Wage. Web Our free payroll tax calculators make it simple to figure out withholdings and deductions in any state for any type of payment. Web Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Figure out your filing status work out your adjusted. Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. Ad Join Thousands Of Other Business Owners Whove Made Their Payroll Management Easier.

Ad Well file your 1099s new hire reports. Web Our employer tax calculator quickly gives you a clearer picture of all the payroll taxes youll owe when bringing on a new employee. Employers can use it to calculate net.

Web The Michigan Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2023. Ad Payroll So Easy You Can Set It Up Run It Yourself. This free easy to use payroll calculator will calculate your take home pay.

Supports hourly salary income and. Your average tax rate. Add W-2 employees at any time.

Get 3 Months Free Payroll. Worksheet 2 Tier 3 Michigan Standard Deduction Estimator. Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility.

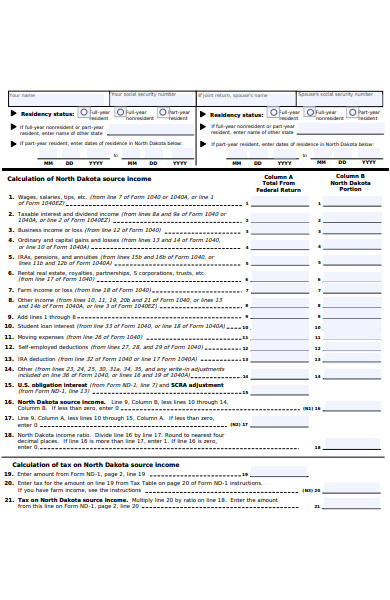

But these cities charge an additional income. For example if an employee earns 1500 per week the. Web Individual Income Tax.

Ad See 2023s Top 10 Payroll Calculators. Web Michigan Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state. Check Our Payroll Software Comparison Charts To find Out Which One Is Most Suited For You.

Ad All-In-One Payroll Solutions Designed To Help Your Company Grow. Web Michigan MI Payroll Taxes for 2023 Michigan has a single income tax rate of 425 for all residents. Get Instant Recommendations Trusted Reviews.

Web Michigan Income Tax Calculator 2022-2023 Learn More On TurboTaxs Website If you make 70000 a year living in Michigan you will be taxed 10930. Make The Switch To ADP. Ad Compare This Years Top 5 Free Payroll Software.

Worksheet 4 Recipients of FIPMDHHS Worksheet 5 Renters Over Age 65. Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. Ad Well file your 1099s new hire reports.

Last Updated on March 08 2023 You may use our free Michigan paycheck calculator to calculate your take.

Contrails 166 By Gary Ferguson Issuu

Free 31 Calculation Forms In Pdf Ms Word

Bad Economy Lost Jobs No Or Low Income And Less Tax Money For The Irs Don T Mess With Taxes

Outline Of The Michigan Tax System 2021 Citizens Research Council Of Michigan

6171 State Route 3 Mexico Ny 13114 Zillow

Calameo Career Press How To Help Your Child Excel In Math An A Z Survival Guide

Michigan Sales Tax Calculator Reverse Sales 2023 Dremployee

Obesity In Children And Young People A Crisis In Public Health Lobstein 2004 Obesity Reviews Wiley Online Library

Michigan Paycheck Calculator Tax Year 2023

The Looming Danger Of Tax Cut Triggers In Michigan Mlpp

0 Curtis Road Hinesville Ga 31313 Compass

Red Hot Best 2021 Northern Michigan S Top Tax Accountants

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu

34 Sample Payroll Checks In Pdf Ms Word Excel

If The Ctc Is 32 Lpa What Is The In Hand Salary In India In 2022 Quora

473 Fern Ave Oxford Wi 53952 Realtor Com

Who Can Pay More The Case For A Graduated Income Tax Mlpp